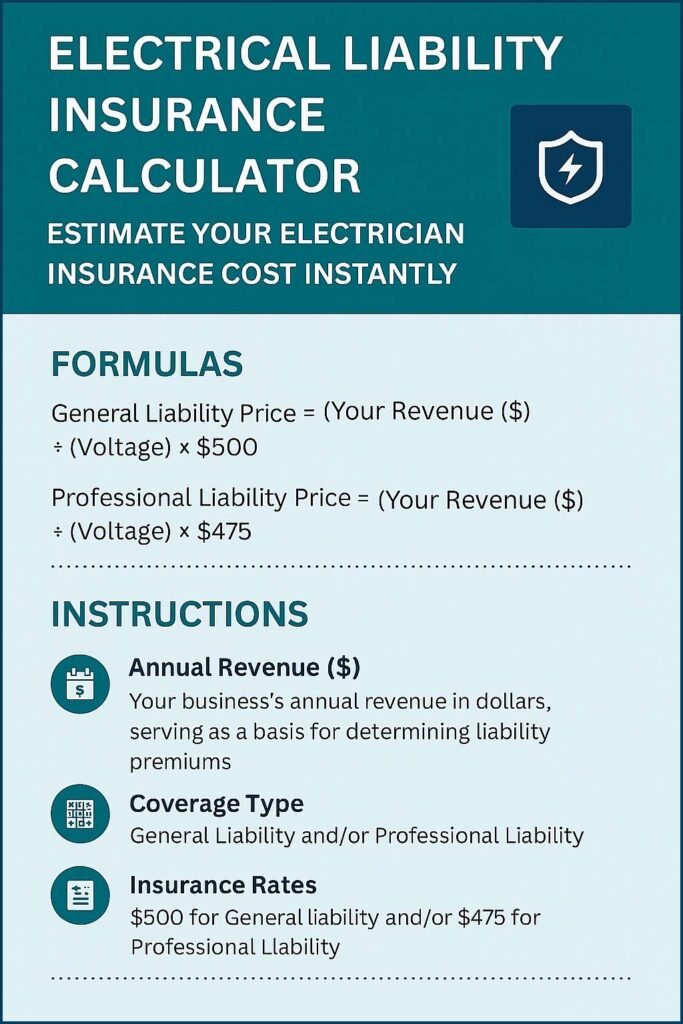

Electrical Liability Insurance Calculator – Estimate Your Electrician Insurance Cost Instantly

Running an electrical business comes with unique risks. From faulty wiring to property damage, one mistake can lead to expensive claims. That’s where an electrical liability insurance calculator becomes essential. This simple tool helps electricians, contractors, and business owners estimate how much insurance coverage they need and what it will cost. In this guide, we’ll explain how the calculator works, what factors affect your insurance premium, and how to use it to protect your electrical business from financial loss.

Table of Contents

What Is an Electrical Liability Insurance Calculator?

An electrical liability insurance calculator is an online tool that helps you estimate your insurance cost based on your business activities, location, and annual revenue. It gives you an approximate premium range for general liability insurance or electrician public liability insurance. The calculator considers factors such as your trade type, number of employees, risk exposure, and previous claim history.

Instead of spending hours requesting multiple quotes from insurance companies, you can use this calculator to get an instant estimate and compare plans easily.

Electrical Liability Insurance Calculator (UK)

Electrical Liability Insurance Calculator (UK)

Estimate your annual insurance premium based on business profile, risk, and coverage needs.

Tools Cover (£100)Employer’s Liability (£150)

Professional Indemnity (£200)

Select your business type, number of employees, and annual turnover. Choose your desired coverage amount and indicate any claims history. Select the risk level of your work and tick any optional add-ons. Click “Calculate” to get an estimated annual premium based on UK underwriting logic, including risk and claims loading.

Why Electricians Need Liability Insurance

Electrical work involves constant exposure to risks like electric shocks, short circuits, or fire hazards. Even a minor mistake can cause major property damage or injury to a third party. Liability insurance acts as a safety net. It covers financial losses that arise from accidents, negligence, or property damage caused during work.

Without insurance, a single claim could severely impact your finances or even shut down your business. That’s why every professional electrician or electrical contractor should use an electrical liability insurance calculator before choosing a policy. It helps you make informed decisions about the coverage you actually need.

Know more about Best Business Insurance for Electrical Contractors in Saint Helena | Top Coverage Options 2025

How Does an Electrical Liability Insurance Calculator Work?

The calculator works by analyzing several input factors to generate an estimated premium. You enter details about your business, such as your work type, size, and coverage limits. The system then uses algorithms based on insurance industry data to produce an estimated cost.

Here’s a simple breakdown of how it calculates your insurance cost:

| Factor | Description | Example Impact |

|---|---|---|

| Business Type | Type of electrical services offered | High-risk (industrial wiring) = higher premium |

| Location | Country or region of operation | Urban areas may cost more |

| Annual Revenue | Total yearly income | Higher revenue increases liability exposure |

| Number of Employees | Workforce size | More employees = higher risk |

| Coverage Limit | Amount of insurance protection | More coverage = higher premium |

| Claim History | Past insurance claims | Frequent claims increase rates |

For example, a small electrician business with two employees and annual revenue of £80,000 may pay around £400–£700 per year for liability insurance. Larger contractors working on commercial projects may pay more depending on the risk level.

Benefits of Using an Electrical Liability Insurance Calculator

Using an electrical liability insurance calculator offers multiple benefits for both individuals and companies.

- Instant Estimates – You can get cost estimates in seconds without contacting brokers or agents.

- Accurate Budgeting – Helps you plan your insurance expenses based on your project and business size.

- Policy Comparison – Enables you to compare coverage options from multiple insurers quickly.

- Time-Saving – Avoids long quote forms or waiting periods.

- Transparency – Understands what factors influence your premium before purchasing a policy.

These advantages make the calculator a must-have tool for every electrician or small business owner dealing with electrical installations, repairs, or maintenance.

Factors That Affect Electrical Liability Insurance Cost

Your electrical liability insurance calculator results depend heavily on several variables. Let’s go deeper into what affects your premium.

1. Type of Electrical Work

Domestic wiring or small repair jobs are low-risk, while industrial or commercial projects carry higher risks. For instance, electricians working in high-voltage environments or construction sites generally pay more.

Use our online tool Home Electrical Insurance Calculator – Protect Your Home Smartly

2. Business Location

Premiums can vary depending on your location. In the UK, for example, electricians in London might pay slightly higher premiums compared to smaller towns due to higher claim rates and cost of living.

3. Business Size and Revenue

The more revenue your company earns, the greater your exposure to liability claims. Larger companies typically require higher coverage limits, leading to higher costs.

4. Coverage Limit and Deductible

Choosing a higher coverage limit gives more financial protection but increases the premium. Similarly, opting for a lower deductible (the amount you pay before insurance kicks in) can also raise your cost.

5. Claim History

If you’ve had previous claims or accidents, insurers may classify you as higher risk. The calculator uses this information to estimate a slightly higher premium.

6. Number of Employees

More workers mean more chances of accidents or mistakes, so premiums rise with team size. Independent electricians usually pay less than businesses with large crews.

7. Type of Clients

Electricians working with commercial or government clients may need higher liability limits, which can also affect the insurance price shown in the calculator.

Typical Coverage Options for Electricians

Before using an electrical liability insurance calculator, it’s helpful to know the common coverage types.

| Coverage Type | What It Covers | Typical Limit |

|---|---|---|

| Public Liability | Third-party property damage or injury | £1M to £5M |

| Product Liability | Faulty equipment or components causing damage | £1M+ |

| Professional Indemnity | Design or advice errors | £250K to £2M |

| Employers’ Liability | Employee injuries or illness | £10M (mandatory in UK) |

| Tools and Equipment Cover | Damage or theft of electrical tools | Based on value |

Understanding these categories ensures your calculator estimate reflects your exact needs.

Use our online tool Solar Panel Insurance Calculator – Estimate Coverage and Cost Easily

How to Use an Electrical Liability Insurance Calculator Effectively

Using the calculator is simple but to get accurate results, follow these steps carefully.

- Enter your business type – choose from residential, commercial, or industrial electrical work.

- Provide your annual revenue and number of employees.

- Select your desired coverage amount.

- Include your business location or postal code.

- Add claim history details if available.

- Review your estimated premium and compare with real quotes.

Most calculators also allow you to customize add-ons like tool insurance or professional indemnity coverage. Always check what’s included before making a decision.

Example: Calculating Your Electrician Liability Insurance

Let’s consider a small electrical contractor in the UK.

| Detail | Input | |

|---|---|---|

| Type of Work | Domestic & Commercial Wiring | Moderate Risk |

| Annual Revenue | £100,000 | |

| Employees | 3 | |

| Coverage Limit | £2,000,000 | |

| Claims in Past 3 Years | None | |

| Estimated Annual Premium | £500 – £850 | Based on calculator estimate |

This example shows how quickly a calculator can generate a realistic range. Once you have an estimate, you can contact insurance providers to finalize the policy.

How to Lower Your Electrical Liability Insurance Premium

Your electrical liability insurance calculator might show a higher cost than expected, but you can still take steps to reduce it.

- Maintain a clean safety record by following all electrical standards.

- Complete certified safety training programs for you and your staff.

- Use high-quality tools and regularly maintain them to prevent accidents.

- Bundle policies (like vehicle or tool coverage) for multi-policy discounts.

- Increase your deductible if you can afford to pay small claims out of pocket.

Insurance providers reward businesses that actively reduce risk. A strong safety record can lower your premium over time.

Use our online tool Electrical Insurance Cost Estimator – Accurate Tool to Calculate Coverage Costs

Why Electricians Should Regularly Recalculate Insurance Costs

Electrical businesses grow and change constantly. Your client base, equipment value, and staff size may evolve. Using the electrical liability insurance calculator every six to twelve months helps ensure your coverage stays accurate. It prevents being underinsured or overpaying for unnecessary protection.

Also, as new insurers enter the market, rates may drop. Regular recalculations help you find better deals without compromising on protection.

Importance of Electrical Liability Insurance in the UK

In the UK, electrical contractors often work in homes, offices, and commercial spaces. Clients usually demand proof of liability insurance before allowing any electrical work. Without it, you could lose contracts or face penalties if something goes wrong.

The electrical liability insurance calculator simplifies the process of meeting these requirements. It ensures you know your expected costs before applying for coverage, saving you from last-minute surprises.

Key Takeaways

- An electrical liability insurance calculator gives electricians a quick and accurate way to estimate insurance costs.

- It factors in business type, size, revenue, and claim history.

- Regular use helps you stay properly insured as your business grows.

- Always compare calculator results with multiple real-world quotes to get the best deal.

Final Thoughts

Electricians face daily risks that can turn costly without the right protection. An electrical liability insurance calculator helps you find the balance between affordable premiums and adequate coverage. It’s not just a tool for numbers—it’s a guide to financial safety for your electrical business.

Use our online tool Electrical Insurance Premium Calculator – Estimate Your Electrical Coverage Cost Online

By using the calculator regularly and understanding your risk profile, you can make smart decisions, protect your assets, and focus on what matters most—delivering safe, reliable electrical services to your clients.

Follow Us on Social:

Subscribe our Newsletter on Electrical Insights to get the latest updates in Electrical Engineering.

#ElectricalLiabilityInsuranceCalculator, #ElectricianInsurance, #LiabilityInsurance, #ElectricalBusiness, #InsuranceCalculator, #ContractorInsurance, #ElectricianTools, #BusinessInsurance, #ElectricalSafety, #InsuranceCostEstimator, #ProfessionalLiability, #ElectricianProtection, #InsuranceForElectricians, #ElectricalContractor, #InsuranceQuotes