Carbon Credits: A Comprehensive Guide

Carbon credit has emerged as a critical weapon within the global fight in opposition to climate trade. These credits offer a realistic manner to cut greenhouse fuel emissions at the same time as additionally promoting sustainability. In this publish, we will take a look at the belief in carbon credit, the Clean Development Mechanism (CDM), and the certification technique for selling carbon credit.

Table of Contents

What are Carbon Credits?

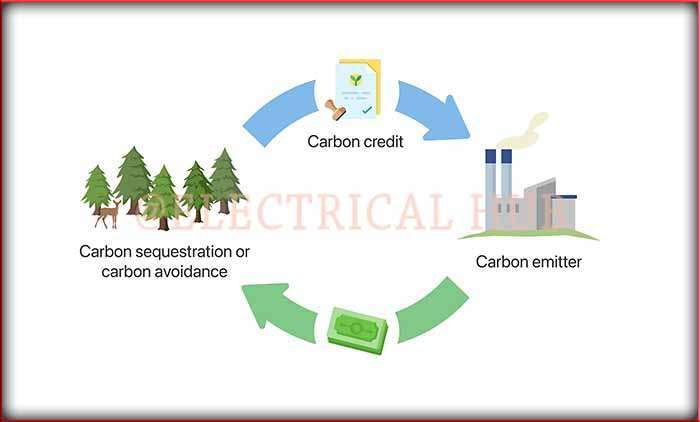

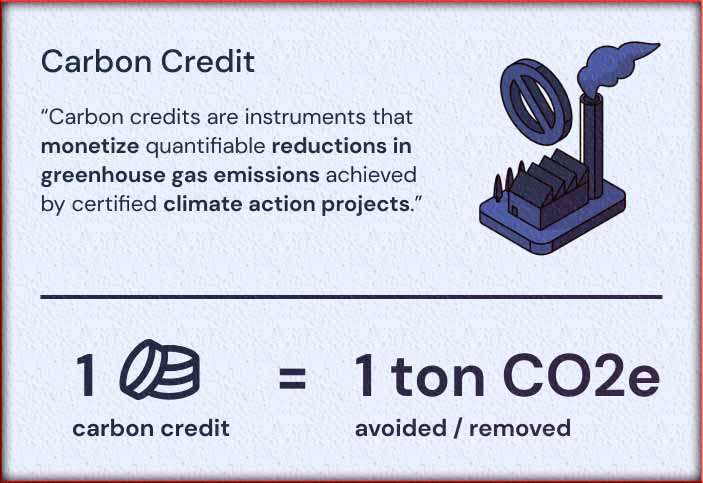

Carbon credits, sometimes called “carbon credits,” are central to international efforts to mitigate climate change. These credits are a standardized measure of how much greenhouse gas emissions are removed or reduced. They are important in the fight against climate change because they provide individuals, businesses, and governments with an easy way to adjust their carbon footprint.

How much is 1 carbon credit worth?

The value of a carbon credit varies significantly primarily based on several elements, inclusive of the carbon market, the form of carbon credit score, and the location or the United States of America wherein it is exchanged. Carbon credits are often related to projects to reduce greenhouse fuel emissions and mitigate climate exchange.

The Carbon Credit is available in several structures, including Certified Emission Reductions (CERs) underneath the Kyoto Protocol‘s Clean Development Mechanism (CDM) or Voluntary Emission Reductions (VERs) in voluntary carbon markets. These credit charges can alter because of delivery and demand dynamics, regulatory adjustments, and market sentiment.

Carbon credits may be priced everywhere from a few dollars to more than $10 consistent with a tonne of CO2 equivalent in some voluntary markets. Prices may be better and subject to authorities’ guidelines in compliance markets, wherein credit is frequently bought as a part of cap-and-trade or emissions buying and selling structures.

The Clean Development Mechanism (CDM)

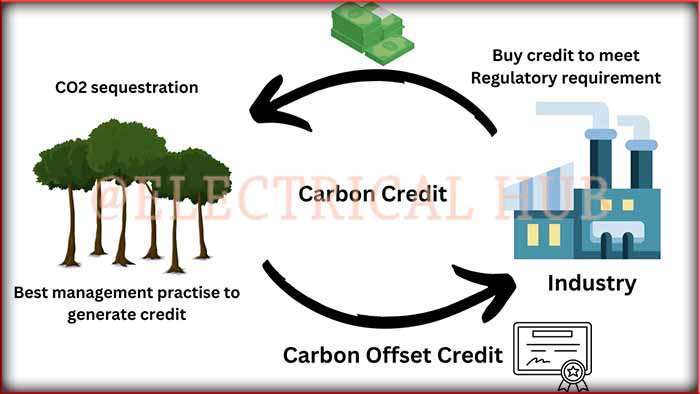

The Kyoto Protocol includes the Clean Development Mechanism, or CDM. This protocol permits rich countries to invest in emission-reduction initiatives in poor countries, generating carbon credit in the process. The Offsets created can be transferred to the investing countries to assist them in meeting their emission reduction targets.

Certification to Sell Carbon Credits

Carbon credit certification and sale is a unique and careful method. It entails several critical steps:

Identification of a Project: The adventure starts with the identification of a venture that can efficiently cut greenhouse gasoline emissions. This can encompass a variety of tasks which include renewable energy installations, forestry efforts, and energy performance improvements.

Project Development: The identified challenge ought to be very well organized via CDM concepts. An entire project design document (PDD) defining the project’s targets, technique, and envisioned emission reductions has evolved.

Validation: An unbiased 0.33 celebration, called a Designated Operational Entity (DOE), is vital in validating the task to make sure it meets CDM criteria.

Registration: After the mission has been assessed satisfactorily, its miles are registered with the CDM Executive Board, permitting it to generate the carbon credit.

Monitoring and Verification: The project must be continuously monitored to precisely track its emissions reductions. Regular verification assures that the emission reductions are legitimate.

Issuance of Carbon Credit: Carbon credits are awarded to the project after successful verification. This carbon credit can subsequently be traded on the carbon market.

Selling Carbon Credits

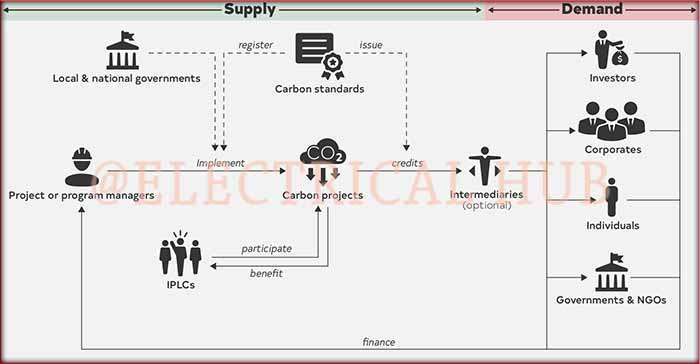

Carbon Offsets are primarily sold by giving them to companies or individuals seeking to offset their carbon emissions. Carbon credits are in high demand as organizations and governments attempt to satisfy their environmental goals or meet legislative obligations. This spike in demand has resulted in the formation of several platforms and markets for the purchase and sale of carbon Offsets.

How do carbon credits get paid?

Carbon credits are often purchased and sold in carbon markets, with payment processes varying based on the individual market and companies involved.

Here’s a high-level description of ways carbon credit is bought:

Reduction or Offsetting Projects: Carbon credits are created whilst initiatives that lessen or offset greenhouse gas emissions are completed. Renewable energy installations, reforestation efforts, strength performance programs, and other sports are examples of such initiatives.

Certification and Verification: An assignment should go through a certification and verification process to generate carbon Offsets. Independent 0.33-birthday party corporations examine the project to ensure that precise emission discount or elimination standards are met. If the project is allowed, it’s going to get a fixed quantity of carbon credit based totally on the range of emissions that will be cut or removed.

Credit Issuance: Once a venture has been authorized and shown, it is assigned a positive quantity of carbon credits, which can be normally quantified in metric tonnes of CO2. These credits are ultimately dispensed to the task or enterprise this are chargeable for emission reductions.

Trading: Carbon credits may be bought in a whole lot of markets, inclusive of compliance markets and voluntary markets. Government agencies often regulate compliance markets, requiring companies problem with emissions caps to buy and surrender credit to meet their regulatory requirements. Voluntary markets, on the other hand, allow companies and those to gather credits to offset their emissions voluntarily.

Payment: When a purchaser in the carbon marketplace purchases credit from a vendor, the credit is paid for. Typically, the price is paid based on the agreed-upon price according to a tonne of CO2 equivalent. The payment can take the shape of an economic transaction, which is generally made in the currency of the market in which the transaction is taking region.

Retirement or Use: The consumer can then make use of the carbon credits they received to offset their emissions or to satisfy regulatory duties. Offsets that have been used for this reason are considered retired and can not be used once more.

It’s important to not forget that the carbon credit score market may be complicated, and the technique can vary based on the market, geography, and criminal framework. Furthermore, carbon credit score costs and values may vary due to delivery and call for, market conditions, and legislative modifications. Carbon credit score consumers and dealers need to obey the unique rules and necessities of the market in which they’re taking part.

To summarise, carbon credits are a critical device within the conflict against climate trade because they permit people, companies, and governments to take concrete moves toward decreasing their carbon footprint.

Understanding the technique of generating and selling carbon credits is vital for anyone wishing to have an excellent environmental impact and make contributions to a greater sustainable destiny. The Clean Development Mechanism’s sturdy framework assures that these credits aren’t the simplest credible but are additionally a critical useful resource in the worldwide effort to address climate exchange.

Follow us on LinkedIn”Electrical Insights” to get the latest updates in Electrical Engineering. You can also Follow us on LinkedIn and Facebook to see our latest posts on Electrical Engineering Topics.

Worth Read Posts

- The Kyoto Protocol 1997: A Comprehensive Guide

- Plant Factor, Plant Capacity Factor, and Load Factor

- Difference Between Demand Factor and Diversity Factor

- Buck Converter Interview Questions

- DC DC Converter Interview Questions

- Transformer Electrical Interview

- Top 30 Op Amp Interview Questions

- Power Electronics Interview Questions